In programmatic, scale without efficiency erodes value.

More impressions don’t automatically translate into higher yield. Not when supply paths are long, fees compound, and signal quality is inconsistent.

Publishers often hear promises about scale. Millions of impressions. Vast reach. Global demand. But volume alone doesn’t drive revenue. In many cases, it does the opposite.

The question isn’t how many impressions you can serve. It’s how much value you extract from each one.

What erodes value at scale

When programmatic infrastructure prioritizes volume over efficiency, several problems compound:

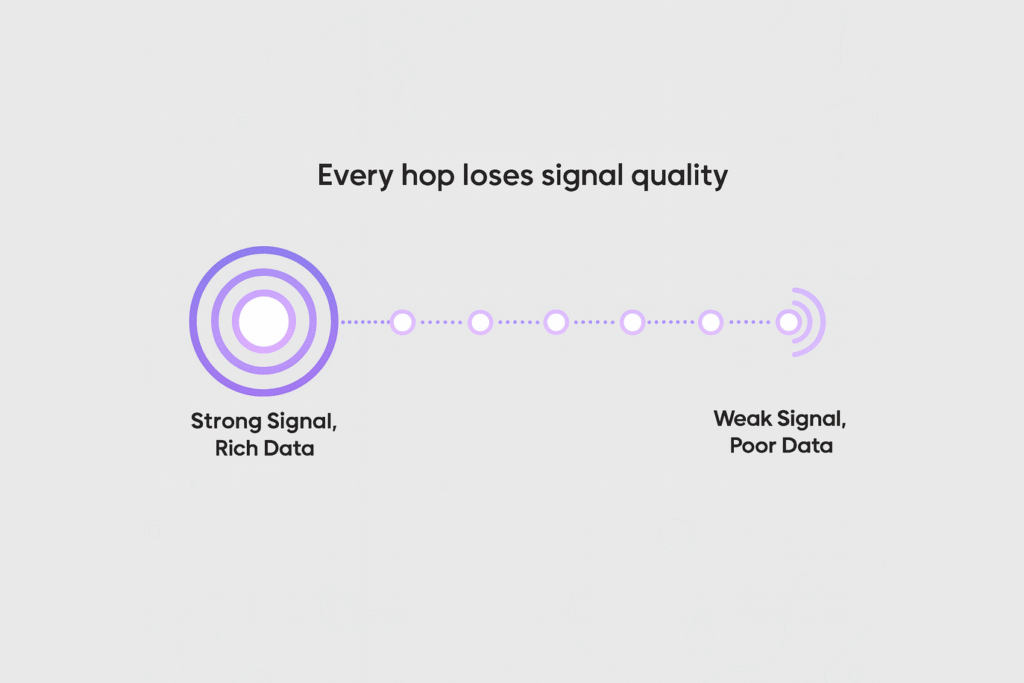

Long supply paths. Every intermediary between buyer and seller takes a cut. A typical programmatic transaction can pass through four to six entities before reaching the publisher. Each hop adds latency, reduces transparency, and extracts fees. By the time the impression is monetized, a significant portion of the buyer’s spend never reaches the publisher.

Fee stacking. Intermediaries charge fees for access, routing, data enrichment, verification, and other services. Individually, these fees seem small. Cumulatively, they can consume 30% to 50% of total spend. Publishers see lower net revenue. Buyers pay inflated costs. The only winners are the layers in between.

Signal degradation. As impressions pass through multiple systems, targeting signals lose fidelity. Cookie syncing fails. Device IDs get lost. Contextual data gets stripped. The buyer ends up bidding on inventory they can’t accurately assess, which lowers bid density and CPMs.

Inconsistent demand quality. Not all demand sources deliver the same performance. Some prioritize volume over conversion. Others lack proper brand safety controls. When publishers chase scale by opening inventory to any available demand, they risk diluting yield with low-quality bids that fill impressions but generate minimal revenue.

These issues don’t disappear at scale. They get worse.

A publisher serving 10 million impressions per month with 40% revenue leakage loses more in absolute terms than one serving 1 million impressions with the same inefficiency. Scaling a broken model just amplifies the problem.

The levers that actually move revenue

The publishers and networks that consistently grow revenue focus on a smaller set of controllable factors. These levers are well known, but not always prioritized:

Direct connections between buyer and seller. The shortest path between demand and supply is the most efficient. Removing intermediaries means fewer fees, lower latency, and better transparency. This doesn’t mean cutting out all partners. It means ensuring that every entity in the chain adds measurable value, not just access.

Transparent, auditable supply chains. Buyers increasingly demand visibility into where their spend goes. Publishers who can provide clear seller paths, validated ads.txt entries, and accurate sellers.json disclosures earn higher trust and better bid density. Opacity creates risk, and risk lowers CPMs.

Brand-safe, validated inventory. Quality matters more than quantity. Inventory that passes brand safety filters, fraud detection checks, and viewability standards consistently earns higher CPMs than unvetted supply. Buyers pay premiums for environments where their ads perform and their brands stay protected.

Demand strategies calibrated for performance outcomes. Not all demand sources are equal. Some buyers optimize for reach. Others prioritize conversions. Publishers who understand which demand partners deliver the best performance for their specific inventory type can optimize yield accordingly. This requires testing, monitoring, and continuous adjustment.

These levers don’t require massive budgets or complex technology. They require discipline, clarity, and focus on what actually drives revenue per impression.

Why CTV, in-app, and web environments need different approaches

The dynamics of efficient scale vary by format.

CTV inventory operates in lean-back environments with limited signal availability. Efficiency here depends on accurate content classification, proper ad pod sequencing, and direct relationships with demand sources that understand CTV attribution. Chasing volume by opening CTV inventory to display-focused buyers dilutes yield because those buyers don’t value the format correctly.

In-app inventory benefits from strong device-level signals but faces challenges with SDK bloat and mediation waterfalls. Efficiency improves when publishers reduce the number of SDKs, optimize mediation order based on actual fill and eCPM data, and prioritize demand sources that respect app performance and user experience.

Web inventory still offers the richest signal environment but faces increasing headwinds from cookie deprecation and privacy regulations. Efficiency depends on investing in first-party data strategies, contextual targeting, and direct integrations with buyers who can monetize cookieless inventory effectively.

In all three environments, the principle remains the same: volume means nothing if each impression generates minimal revenue.

What serious players prioritize

Publishers and networks operating at serious scale don’t chase impressions. They optimize for revenue per thousand impressions, fill rate quality, and buyer retention.

They ask different questions:

- Which demand sources consistently deliver the highest net revenue after fees?

- Where are we losing signal quality in the supply chain, and how do we fix it?

- Which inventory segments justify premium pricing, and which should be deprioritized?

- How many intermediaries are in our supply path, and can we reduce that number?

These questions lead to operational decisions that improve efficiency:

- Consolidating demand partners instead of adding more

- Investing in direct integrations rather than relying on resellers

- Auditing and cleaning ads.txt files to ensure accurate authorization

- Monitoring seller paths and eliminating redundant hops

- Testing new demand sources based on net revenue impact, not gross bid volume

The result is sustainable revenue growth that doesn’t depend on traffic increases. Even if impression volume stays flat, yield improves because each impression is monetized more effectively.

The cost of ignoring efficiency

Publishers who prioritize volume over efficiency eventually hit diminishing returns.

Traffic growth slows. Audience attention fragments. Competition for impressions increases. When the only lever you’ve pulled is scale, you have no room to maneuver when scale stops growing.

Meanwhile, the inefficiencies you ignored compound. Fees continue stacking. Signal quality keeps degrading. Demand partners who don’t deliver performance keep taking up mediation slots. Revenue per impression stagnates or declines.

At that point, fixing the problem requires operational surgery: cutting partners, renegotiating terms, rebuilding supply paths, and sometimes accepting short-term revenue dips to establish long-term efficiency.

It’s easier to build efficiency into the model from the start.

How BidFuse approaches this

At BidFuse, we don’t sell scale. We optimize for it.

That means every publisher integration starts with an audit of their current setup. We identify where value is leaking, where supply paths can be shortened, and where demand quality can be improved.

We prioritize:

- Direct demand relationships that reduce intermediary fees

- Clean seller paths validated through continuous ads.txt and sellers.json monitoring

- Demand sources proven to deliver performance, not just volume

- Transparent reporting so publishers see exactly where their revenue comes from

The goal isn’t to maximize impressions served. It’s to maximize revenue extracted from the impressions you already have.

For serious players in CTV, in-app, and web, that’s the only approach that scales sustainably.

The bottom line

There are two ways to grow programmatic revenue.

The first is to serve more impressions. Add more traffic sources. Expand into new geos. Open more demand pipes. Keep scaling.

The second is to extract more value from every impression you already serve. Shorten supply paths. Validate demand quality. Remove intermediaries that don’t add measurable value.

The first approach works until it doesn’t. Traffic plateaus. Competition increases. CPMs compress.

The second approach compounds. Every efficiency gain applies to every future impression. Better monetization today means better revenue tomorrow, without needing more traffic.

At BidFuse, we’ve seen both paths. Only one builds publishers that last.